Looking to Boost Your Credit Score?

Get your target credit score in months not years.

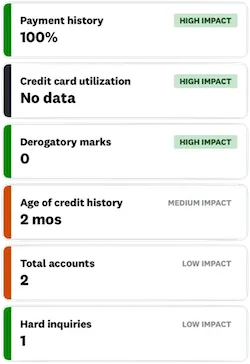

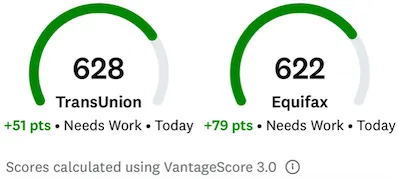

Before Tradeline

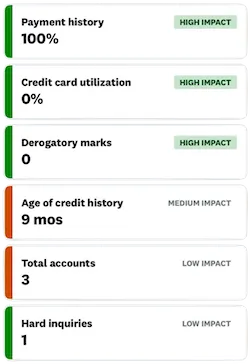

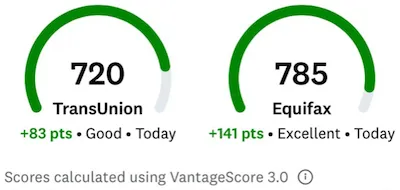

After Tradeline

RESULT

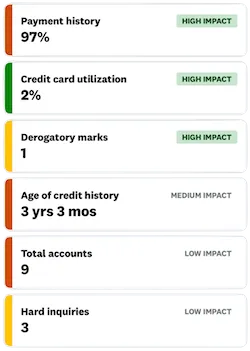

Before Tradeline

After Tradeline

RESULT

Tradeline Credit - How it works!

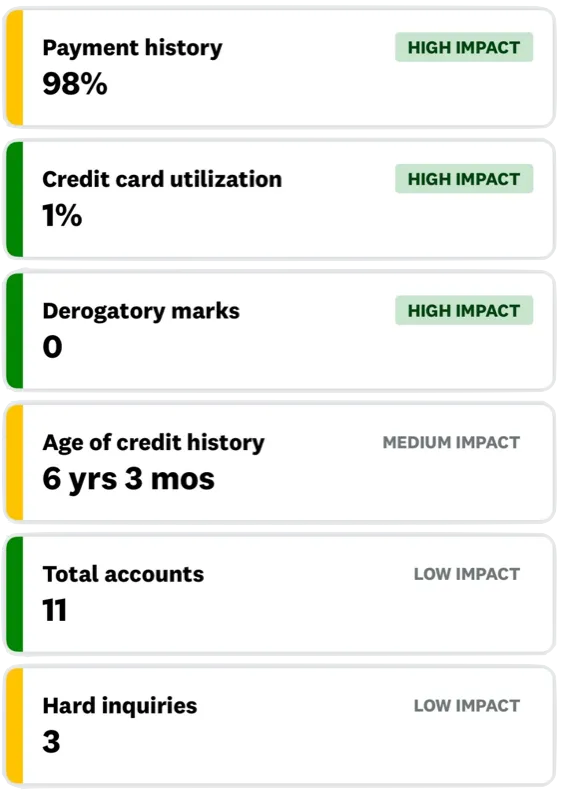

A tradeline records a consumer’s account status and activity. Tradeline data includes the names of companies where the applicant has accounts, the dates accounts were opened, credit limits, account types, outstanding balances, and payment histories.

An “authorized user” is a person who has access to an account as a user but is not responsible for the balance. The term “authorized user tradelines” is now synonymous with a credit improvement approach in which individuals, such as yourself, can pay to be added as an authorized user only for the purpose of having the account’s history displayed on their own account.

You won’t be able to access the card, but your report will show the account’s history.

Keep in mind that adding an authorized user to a credit account does not always result in a score boost. Why? If you’re added as an authorized user and the account has a late payment or high utilization, the account will show on your credit report, which will most likely lower your credit score.

However, if the credit account is in good standing and contains a 100% payment history with low credit card usage, it could significantly improve the authorized user’s credit score.

Here are 2 case studies of before and after comparisons to understand how authorized user’s tradeline credit secrets work.

By submitting your contact information you also expressly consent to having us and our affiliates contact you about your inquiry by text message, email, or phone to the residential or cellular telephone number you have provided. Even if that telephone number is on a corporate, provincial/state, or nation Do Not Call Registry. You expressly agree to this site's Security Statement and our Privacy Policies.

This is not a commitment to lend or extend credit. Restrictions may apply. Rates may not be available at time of application. Information and/or data are subject to change without notice. All loans are subject to credit approval. Not all loans or products are available in all provinces/states.